What do landlords need to know about Making Tax Digital?

Part of our Making Tax Digital for Income Tax series

MTD for Income Tax & Self-Assessment (MTD for ITSA) is part of the UK government’s long-running plans to digitalise tax.

Doing so makes life easier for individuals and businesses who, because their records are digital, get improved visibility into their finances. This empowers better decision-making, the ability to spot problems before they arise and assists growth.

The MTD programme has already required VAT-registered businesses over the VAT threshold to use software for their VAT accounting as of April 2019. The remained of VAT businesses have had to follow those rules from April 2022.

The next phase of the project begins in April 2024, when many individuals and the self-employed, currently using Self-Assessment, will be required to switch to using MTD for Income Tax for their income tax accounting and reporting.

This includes landlords, but only those whose rental income (not profit) from their property or properties exceeds £10,000 per year.

If a landlord is also a sole trader, then the income from the sole trader business(es) they own, plus the income from properties, is added together for the purpose of determining if that individual is required to register for MTD for Income Tax.

What do landlords need to do for MTD for Income Tax?

For those within its scope, as described above, the rules of MTD for Income Tax are as follows:

Software compatible with MTD for Income Tax must be used to record the property income and expenses. We recommend Xero accounting software, which is the most user friendly and has various monthly pricing options.

You or your accountant must register you for MTD for Income Tax before 6 April 2024. If you’re already registered for Self-Assessment or have already registered for MTD for VAT, you will not be transferred across automatically when MTD for Income Tax begins.

You’ll no longer need to send a Self-Assessment return for income tax unless you need to report other kinds of income outside the scope of MTD for Income Tax. This will be submitted in addition to fulfilling your requirements that arise from MTD for Income Tax.

You must then provide HMRC with quarterly updates using the software. You can send updates more frequently than quarterly, if this better suits your business. There’s no legal requirement for the updates to be 100% accurate, but doing so will help you see your predicted tax and National Insurance liability. It will also cause less work on your end of period statement.

How to get started with MTD for Income Tax if you’re a landlord?

If you’re a landlord, Making Tax Digital might sound daunting. But it doesn’t have to be the case. You can download our free Making Tax Digital For Landlords Guide!

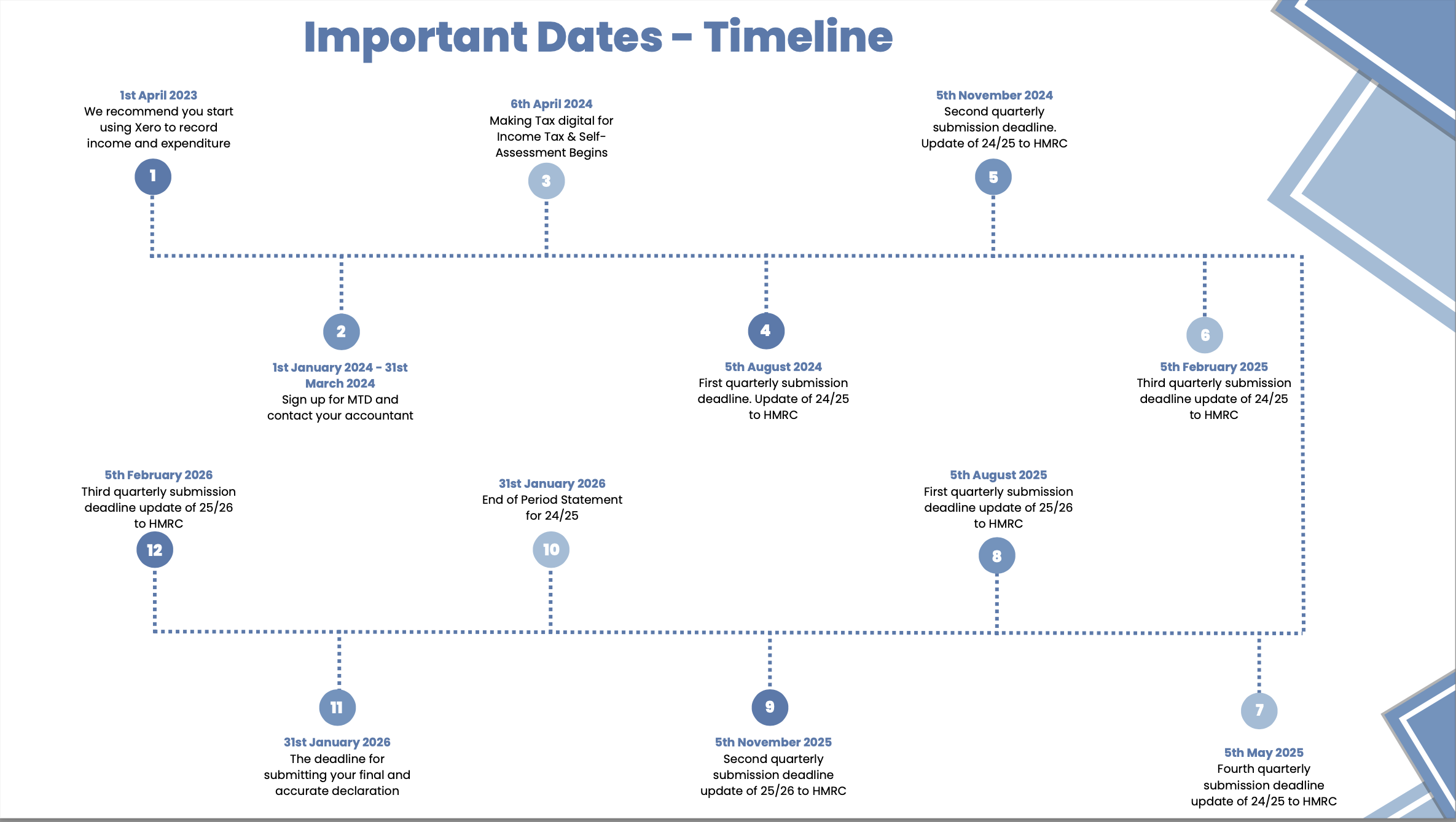

Check out our simple timeline of important dates below and you’ll be ready to deal with MTD in plenty of time.