Tax Knowledge Base

What does payments on account mean?

Payments on account are advance payments towards your bill (including class 4 national insurance if you’re self-employed).

You have to make 2 payments on account every year unless:

- Your last self-assessment tax bill was less than £1,000

- You’ve already paid more than 80% of all the tax you owe, for example through your tax code or because your bank has already deducted interest on your savings.

Each payment is half your previous year’s tax bill. Payments are usually due by midnight on 31st January and 31st July.

If you still have tax to pay after you’ve made your payments on account, you must make a balancing payment by midnight on 31st January next year.

Here’s an example: Your bill for the 2020 to 2021 tax year is £3,000. You made 2 payments on account last year of £900 each (totalling £1,800).

The total tax to pay by midnight on 31st January 2022 is £2,700. This includes:

- Your balancing payment of £1,200 for the 2020 to 2021 tax year (£3,000 minus £1,800)

- The first payment on account of £1,500 (half of your 2020 to 2021 tax bill) towards your 2022 to 2023 tax bill

You then make a second payment on account of £1,500 on 31st July 2022.

If your tax bill for the 2020 to 2021 tax year is more than £3,000 (the total of your 2 payments on account), you’ll need to make a balancing payment by 31st January 2023.

Reminder: Payments on account do not include anything you owe for capital gains or student loans (if you’re self-employed) – you’ll pay those in your balancing payment.

Dividend Tax

How are dividends taxed?

You may get a dividend payment if you own shares in a company. You can earn some dividend income each year without paying tax.

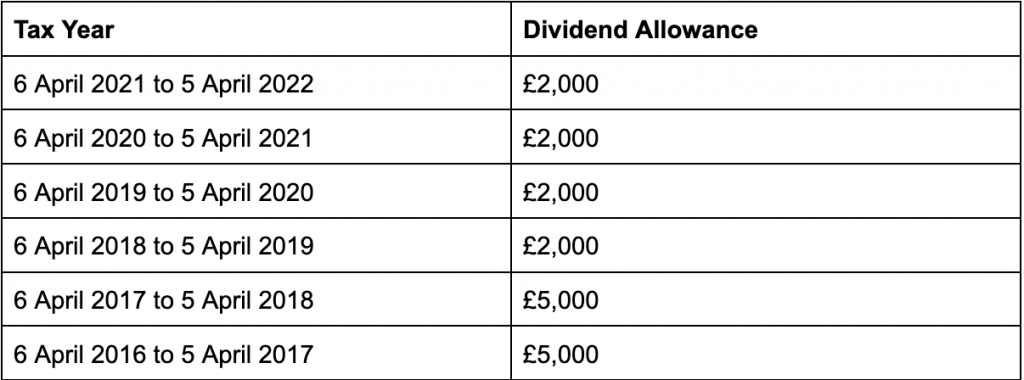

You do not pay tax on any dividend income that falls within your personal allowance (the amount of income you can earn each year without paying tax). You can also get a dividend allowance each year. You only pay tax on any dividend income above the dividend allowance.

You do not pay tax on dividends from shares in an ISA.

Working out tax on dividends

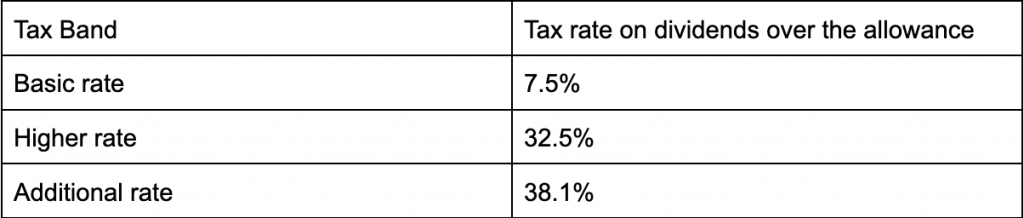

How much tax you pay on dividends above the dividend allowance depends on your Income-tax band.

From April 2022 tax on dividend income will increase by 1.25 percentage points to support the NHS, health and social care.

To work out your tax band, add your total dividend income to your other income. You may pay tax at more than one rate.

Here’s an example:

You get £3,000 in dividends and earn £29,570 in wages in the 2020 to 2021 tax year. This gives you a total income of £32,570. You have a personal allowance of £12,570. Take this off your total income to leave a taxable income of £20,000.

This is in the basic rate tax band, so you would pay:

- 20% tax on £17,000 of wages

- No tax on £2,000 of dividends because of the dividend allowance.

- 7.5% tax on £1,000 on dividends

How to pay HMRC for Income Tax, Corporation tax and PAYE

Your bill will tell you whether you need to pay into Shipley or Cumbernauld. If you don’t have a bill or are unsure, just pay into Cumbernauld.

Here are the account details you need to know:

Account name: HMRC Cumbernauld

Sort code: 08-32-10

Account number: 12001039

Account name: HMRC Shipley

Sort code: 08-32-10

Account number: 12001020

In the reference section please ensure you add the reference of the tax you’re paying:

Income Tax – Your Unique Tax Reference (UTR)

Corporation tax: The Company UTR

PAYE: Your PAYE reference number

Company cars

For employees

You’ll pay tax if you or your family use a company car privately, including for commuting. You pay tax on the value to you of the company car, which depends on things like how much it would cost to buy and the type of fuel it uses.

The value of the car is reduced if:

- You have it part-time

- You pay something towards its cost

- It has low CO2 emissions

If your employer pays for fuel you use for personal journeys, you’ll pay tax on this separately.

If you drive a hybrid: If your company car has CO2 emissions of 1 to 50g/km, the value of the car is based on its zero-emission mileage figure or electric range. This is the distance the car can go on electric power before its batteries need recharging.

Check or update your company car tax

You need to tell HMRC if your car or fuel details change, for example, if:

- You get a company car or give one back

- Your employer starts or stops paying for fuel for you to use personally.

You can see how much tax you might pay with HMRC’s company car and fuel benefit calculator

For employers

As an employer, if you provide company cars or fuel for your employee’s private use, you’ll need to work out the taxable value so you can report this to HMRC.

Private use includes employees’ journeys between home and works unless they’re travelling to a temporary workplace.

You can calculate the taxable value using HMRC’s calculator.

Here’s how to use the calculator:

Choose fuel type ‘F’ for diesel cars that meet the Euro 6d standard (also known as real driving emissions 2). Choose type ‘D’ for other diesel cars.

Choose type ‘A’ for all other cars.

For electric cars and other cars with an approved CO2 emissions figure of 75g/km or less, answer ‘no’ to the question ‘is the car provided via an optional remuneration arrangement?’.

If your car has an approved CO2 emissions figure of 1 to 50g/km you’ll also need to fill in the box for ‘zero-emission mileage’ (also known as an electric range). This is the distance the car can go on electric power before its batteries need recharging.

You can get your zero-emission mileage figure from:

- Your vehicle’s certificate of conformity if you own the car

- The leasing company or fleet provider if you lease the car.

What allowable expenses can I claim?

If you’re self-employed then you’ll pay income tax on your taxable income, meaning you will need to calculate and pay your own tax via a self-assessment tax return. When calculating your taxable income you can also claim for certain business expenses as a deduction Here is a list of some allowable expenses you can claim:

- Office supplies

This can be things such as

- Stationary

- Printing costs/ink

- Postage

- Phone and internet expenses

- IT Software

2. Business premises

- Rent

- Business rates

- Utilities

- Buildings insurance

- Maintenance

3. Transport

This would include any travel necessary for the purposes of your work but can NOT include travel to and from your workplace.

4. Professional costs

This would be accountants, financial advisors, solicitors etc. You can claim their fees as expenses but only for business reasons, nothing related to your personal expenses.

5. Marketing

Your marketing costs will be allowable expenses, whether that’s external advertising or your website costs.

6. Professional insurance

Some jobs require you to have special insurance, for example, public liability insurance, professional indemnity insurance or travel insurance.

7. Clothing

Any clothing (e.g a uniform or costume) that you need to do your job is tax-deductible.

If you work from home you can still claim expenses towards items such as heating, electricity, council tax, rent, internet and phone usage. However, you can only claim for the proportion of these that you use for your home office. A good way to calculate the correct proportion is to use the number of rooms in your home so for example if your home has 3 rooms, one of which is your office, one-third of your heating bill may be tax-deductible. However, be extremely careful if using this method as it can lead to issues such as whether business rates should apply and lead to capital gains tax issues when selling your home. You may wish to use the simpler method of claiming HMRC approved rate of £6 per week, to cover these costs.

Other Knowledge Base Topics

General

Find out the answer to our most asked questions regarding general business queries.

*Disclaimer. Brooks Finance and Business Experts assumes no responsibility or liability for any errors or omissions in the content of this site. The information contained in this site is provided on an “as is” basis with no guarantees of completeness, accuracy, usefulness or timeliness. The information is in no way a substitute for professional advice, so please contact us for specialist advice.